nebraska sales tax percentage

Enter zip code of the sale location or the sales tax rate in percent Sales Tax. 15 combined rate of 7 Papillion.

Sales Taxes In The United States Wikiwand

15 combined rate.

. Please select a specific location in Nebraska from the list below for specific Nebraska Sales Tax Rates for each location in 2022 or calculate. For tax rates in other cities see Nebraska sales taxes by city and county. The state sales tax rate in Nebraska is 55 but you can customize this table as needed to reflect your applicable local sales tax rate.

Sales Tax Rate s c l sr. Nebraska Non-motor Vehicle Sales Tax Collections by County and Selected Cities 19992021 Annual Non-motor Vehicle Sales Tax Collections Monthly Non-motor Vehicle Sales Tax Collections Non-motor vehicle sales tax collections are compiled from county and city information that is selfreported by applicants when requesting a sales tax permit. If local tax applies enter your local code and multiply your total taxable purchases by the local rate 005 010 015 0175 or 02.

31 rows The state sales tax rate in Nebraska is 5500. So whilst the Sales Tax Rate in Nebraska is 55 you can actually pay anywhere between 55 and 75 depending on the local sales tax rate applied in the municipality. The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68.

The Omaha Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Omaha local sales taxesThe local sales tax consists of a 150 city sales tax. 536 rows Nebraska Sales Tax55. Counties and cities in Nebraska are allowed to charge an additional local sales tax on top of the state sales tax.

While many other states allow counties and other localities to collect a local option sales tax Nebraska does not permit local sales taxes to be collected. Ainsworth 15 70 07 52-003 00415 Albion 15 70 07 81-004 00555 Alliance 15 70 07 27-008 00905 Alma 20 75 075 82-009 00975 Ansley 10 65 065 234-015 01535 Arapahoe 10 65 065 157-016 01780 Arcadia 10 65 065 192-017 01850 Arlington 15 70 07 206-018 01990 Arnold 10. New local sales and use tax.

Wayfair Inc affect Nebraska. The County sales tax rate is. Did South Dakota v.

You may owe use tax if you have not paid the Nebraska sales tax or any applicable local sales tax on purchases delivered into Nebraska from out-of-state mail order or Internet sellers. The Nebraska sales tax rate is currently. Calculate By ZIP Code or manually.

The Ord Sales Tax is collected by the merchant on all qualifying sales made within Ord. The Ord Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Ord local sales taxesThe local sales tax consists of a 150 city sales tax. The state capitol Omaha has a.

Current Local Sales and Use Tax Rates and Other Sales and Use Tax Information. Nebraska provides no tax breaks for Social Security benefits and military pensions while real estate is assessed at 100 market value. Local Sales and Use Tax Rates.

With local taxes the. Calculate By Tax Rate or calculate by zip code. 15 combined rate of 7 Local sales and use tax rate increase.

The Nemaha sales tax rate is. The base state sales tax rate in Nebraska is 55. The Nebraska State Nebraska sales tax is 550 the same as the Nebraska state sales tax.

Find your Nebraska combined state and local tax rate. 15 combined rate of 7 Wilber. The Nebraska state sales and use tax rate is 55 055.

The 2018 United States Supreme Court decision in South Dakota v. The 2018 United States Supreme Court decision in South Dakota v. Did South Dakota v.

Wayfair Inc affect Nebraska. The 55 sales tax rate in Nemaha consists of 55 Nebraska state sales tax. Nebraska Department of Revenue.

Nebraska Sales Tax Rate Finder. 2 combined rate of 75 Weeping Water. Nebraska has state sales tax of 55 and allows local.

The Omaha sales tax rate is. Nebraska sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. Groceries are exempt from the Ord and Nebraska state sales taxes.

There is no applicable county tax city tax or special tax. The County sales tax rate is. You can print a 55 sales tax table here.

Depending on local municipalities the total tax rate can be as high as 75 but food and prescription drugs are exempt. Has impacted many state nexus laws and sales tax collection requirements. The following sales and use tax rate changes will take effect in Nebraska on January 1 2017.

The Nebraska sales tax rate is currently. Local tax rates in Nebraska range from 0 to 2 making the sales tax range in Nebraska 55 to 75. The Omaha Sales Tax is collected by the merchant on all qualifying sales made within Omaha.

The Nebraska NE state sales tax rate is currently 55.

States With Highest And Lowest Sales Tax Rates

Nebraska Drops To 35th In National Tax Ranking

Nebraska Sales Tax Small Business Guide Truic

This Map Shows How Taxes Differ By State Gas Tax Healthcare Costs Better Healthcare

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

The Kiplinger Tax Map Guide To State Income Taxes State Sales Taxes Gas Taxes Sin Taxes Gas Tax Healthcare Costs Better Healthcare

How Oklahoma Taxes Compare Oklahoma Policy Institute

Sales Tax On Grocery Items Taxjar

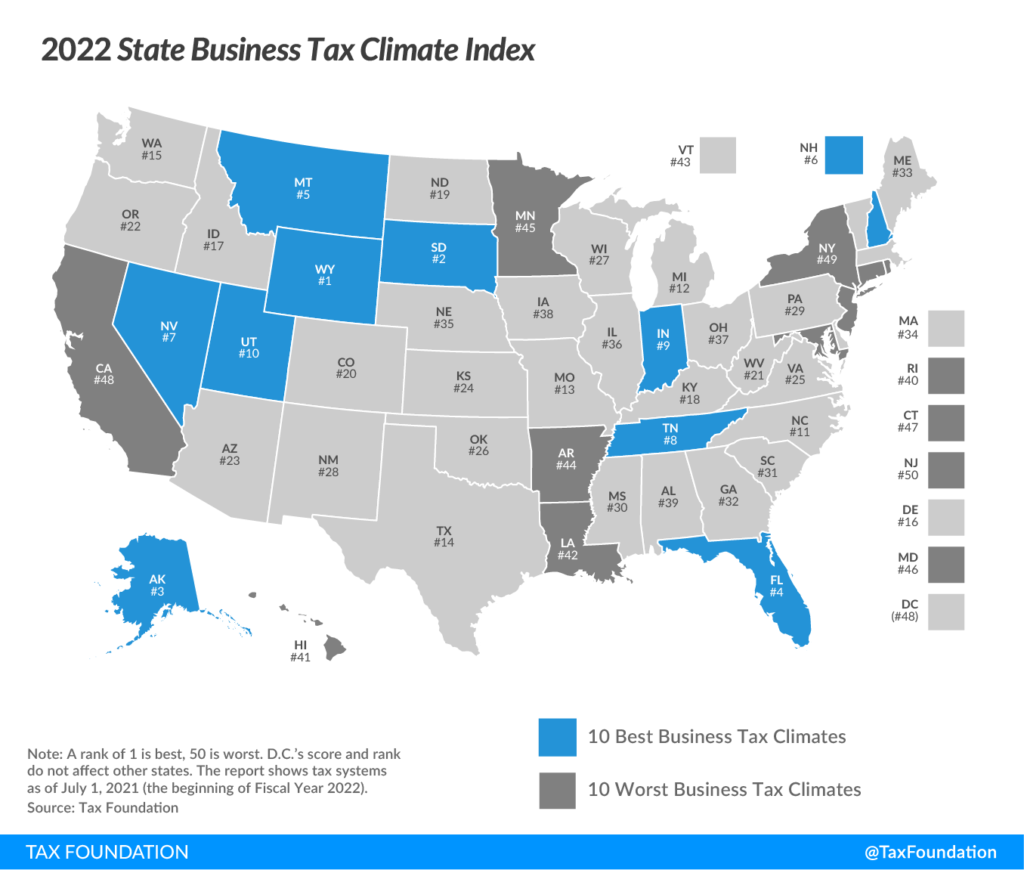

The Corporate Tax Component Of Our Index Measures Each State S Principal Tax On Business Activities Most States Levy A Corporat Business Tax Income Tax Income

Taxes And Spending In Nebraska

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

Ranking State And Local Sales Taxes Tax Foundation

Nathan Madden On Twitter Healthy Kids Grocery Kansas

Sales Tax On Saas A Checklist State By State Guide For Startups

Marketplace 1997 Nebraska Championship Poster Nebraska Husker Football Nebraska Cornhuskers